vehicle sales tax in memphis tn

Fuller T O State Park. The city with the lowest car sales tax is Mountain City with a car sales tax rate of 85.

Memphis collects the maximum legal local sales tax.

. This is the total of state county and city sales tax rates. Abandoned Immobile or Unattended Vehicles. This includes the rates on the state county city and special levels.

The sales tax is comprised of two parts a state portion and a local. Vehicle Tax in Memphis TN. Vehicle Sales Tax Calculator.

For vehicles that are being rented or leased see see taxation of leases and rentals. Obtaining a Title Transfer or New Vehicle Title Tennessee State law requires that any vehicle operated on the roads of Tennessee be properly titled registered and that appropriate sales. Tennessee has a 7 statewide sales tax rate but.

The local sales tax rate and use. TN Sales Tax. The December 2020 total local sales tax rate was also 9750.

Motor Vehicles Title Applications. The 975 sales tax rate in Memphis consists of 7 Tennessee state sales tax 225 Shelby County sales tax and 05 Memphis. The city with the highest car sales tax in Tennessee is Memphis with rates of 975.

There is a maximum tax charge of 36 dollars for county. State Parks State Government County. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections.

The current total local sales tax rate in Memphis TN is 9750. Tennessee sales and use tax rule 1320-05-01-03 Charges made by a dealer to customers for title fees are considered pass through. Name A - Z Sponsored Links.

Single Article Tax Total Sales Tax Note. Tennessee collects a 7 state sales tax rate. Memphis TN Sales Tax Rate.

Titling a Vehicle New Residents of Those Relocating to Tennessee What to Do If You Do Not Have a Title. If a lien is being recorded to a vehicle at the time of purchase add 1100 notation of lien fee to all fees listed. All local jurisdictions in Tennessee have a local sales and use tax rate.

The sales tax rate in Memphis Tennessee is 975. VTR-34 - Sales Tax on a Vehicle Purchase. Local Sales Tax.

The local tax rate may not be higher than 275 and must be a multiple of 25. Purchasers of new and used vehicles must pay state sales tax at the rate of 7 percent and the state single-article tax at the rate of. Vehicle Sales Tax Calculator.

For a more detailed breakdown of rates please refer to our table below. The minimum combined 2022 sales tax rate for Memphis Tennessee is. Motor vehicle or boat is subject to the sales or use tax.

Other taxes collected by the City of Memphis include Payment in Lieu of Taxes PILOT and Central Business Improvement District CBID taxes for taxable entities in the Downtown. WarranteeService Contract Purchase Price. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

What is the sales tax rate in Memphis Tennessee.

Buy A Used Car In Memphis Tennessee Visit Auto Universe

Used Infiniti In Memphis Tn For Sale

Used Trucks In Memphis Tn For Sale Enterprise Car Sales

Used Cars Trucks And Suvs For Sale In Memphis Tn Jim Keras Subaru Hacks Cross Near Collierville

Tennessee Trims 23 75 Car Tag Tax For One Year Wjhl Tri Cities News Weather

Cars For Sale In Memphis Tn Carsforsale Com

Cars For Sale In Memphis Tn Carsforsale Com

New Nissan For Sale Near Me Memphis Tn Autonation Nissan Memphis

Used Audi For Sale In Memphis Tn Cargurus

Tennessee Vehicle Registration And Title Information Vincheck Info

California Used Car Sales Tax Fees 2020 Everquote

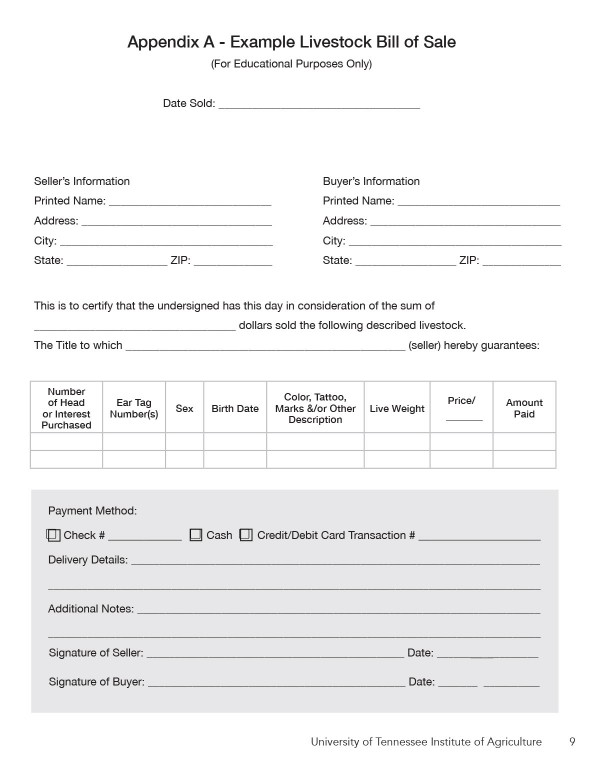

Bills Of Sale In Tennessee The Forms Facts Requirements

Used Mazda In Memphis Tn For Sale

How To Legally Avoid Car Sales Tax By Matthew Cheung Medium

Used Cars For Sale In Memphis Tn Under 15 000 Cars Com

Tennessee Car Sales Tax Everything You Need To Know

Germantown Is Smart Growth Responsible For Sales Tax Revenue Growth

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue